Last updated on September 7, 2017

Maximum number of organizations from different industries are adopting cloud computing due to its advantages. There is a huge transition in businesses due to cloud. Initially organization utilized services offered by public cloud providers like AWS. Then IT giants offered private cloud to have much better control over operations and data. After emergence of Hybrid Cloud, we have seen a shift in cloud market.

Objective of the article to analyze state of the cloud & adoption trends reports published by Rightscale and Bessemer Venture Partners for 2017.

Statistics published by Rightscale are more towards indication of cloud deployment methodologies adoption, usage of products and concerns which can impact cloud computing market in upcoming time. Whereas, BVP reports talks about finances & ideal formula’s for successful cloud business.

Rightscale The State of Cloud Report for 2017

Brief Summary

- Hybrid Cloud is preferred cloud strategy.

- Adoption of public cloud is growing as private cloud adoption is decreasing.

- Azure is dominating public cloud market.

- Increased adoption of Azure Pack/Stack and Openstack for private cloud. Out of it, progress of Azure Pack/Stack is considerable.

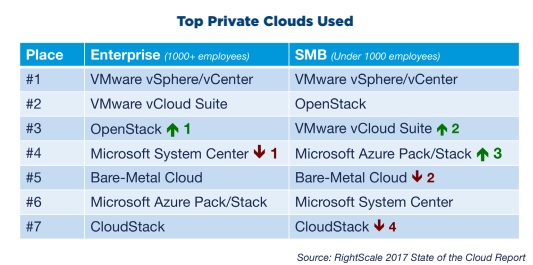

- For private cloud adoption, both enterprises and SMBs are preferring vSphere and vCloud over open source platform Openstack.

- AWS is still earning more revenue. But Azure has shown significant growth and leading towards more number of customers. Workload on Google cloud also increased but it is far way to go.

- As the organizations are getting matured to cloud, challenges like managing, expertise & security are getting reduced.

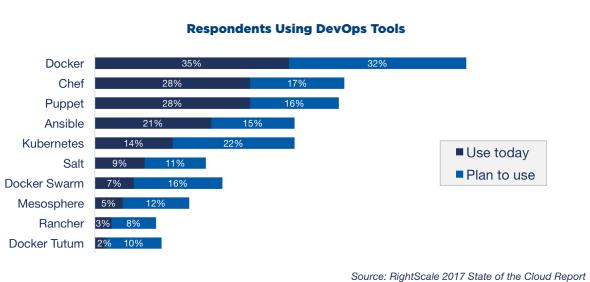

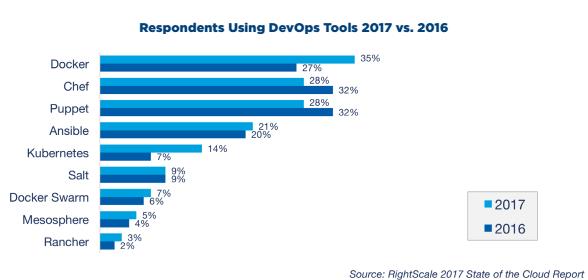

- Docker is getting more attraction as a DevOps tool in the survey. Use of configuration management tools such as Puppet & Chef has been flattened. Implementation of Kubernetes as orchstration tool has been increased as well.

Detailed Analysis of Rightscale State of the Cloud Report 2017

- Total respondents for survey conducted by Rightsale are 1002.

- Respondents were categorized into Enterprises(1000+ employees) and SMBs(<1000 employees).

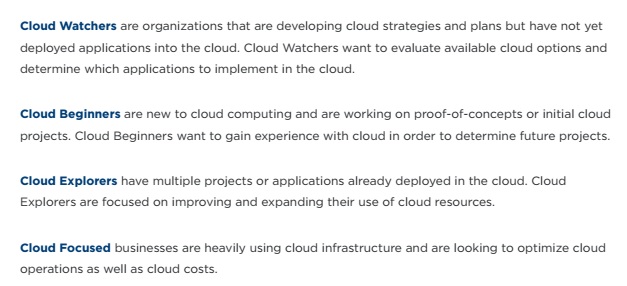

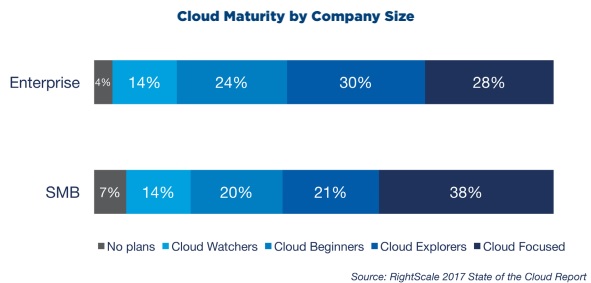

- In this report, Rightscale used its cloud maturity model to segment and analyze based on their level of cloud adoption.

Image – Cloud Maturity Model by Rightscale It has been seen that smaller companies have become more Cloud Focused.

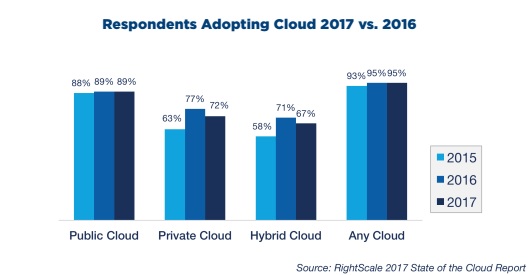

- In 2017, 95% of respondents are using cloud. Use of private cloud is fallen as compare to Rightscale report published in 2016. As a result, hybrid cloud adoption has also fell.

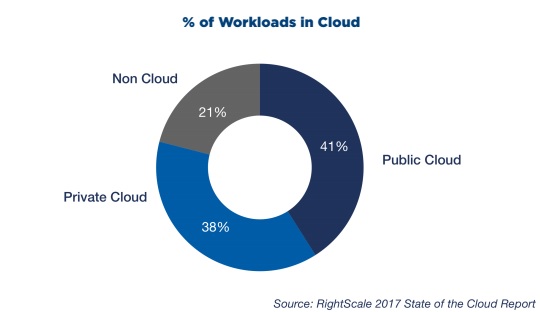

- 79% companies are now running their workloads in cloud. Out of that 41% are using public cloud and 38% are using private.

- Enterprises are running maximum % of cloud as private cloud. But SMBs are more depends on public cloud than private cloud. This shows enterprises are putting efforts to build their own cloud and SMBs wants to take advantage of services offered in public cloud without building their own in-prises cloud.

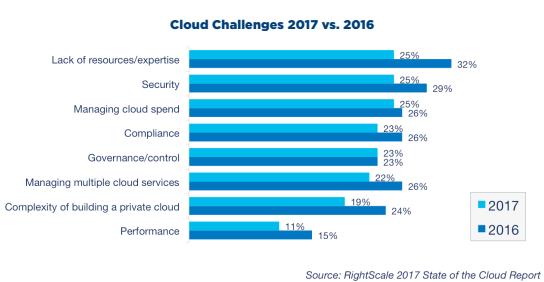

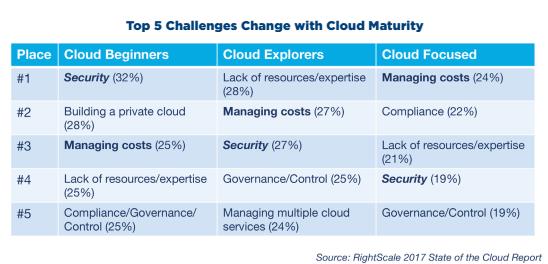

- There were many challenges faced while managing and deploying cloud. It includes lack of expertise, security, managing cloud spend, compliance, governance & performance. As compare to 2016 report, all the challenges were reduced. For bigger enterprises it was significant drop in security concerns.

- Top priority for Cloud Beginners is security and cloud focused enterprises prioritizing reducing cost.

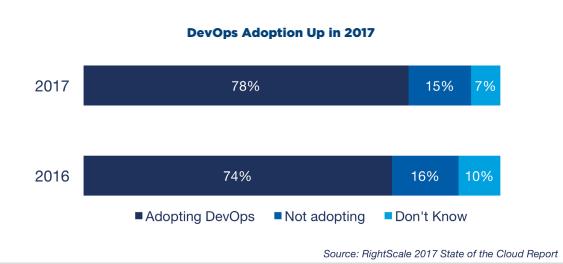

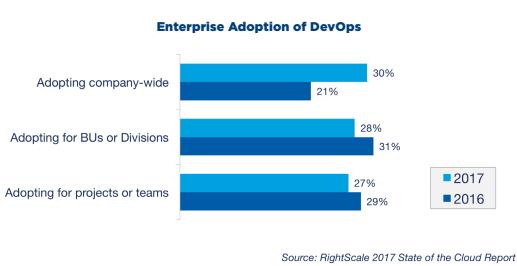

- DevOps adoption by enterprises has been increased as compare to 2016 report.

- Company-wide DevOps adoption is significantly increased from 21% to 30% in enterprises

- Docker is mostly used DevOps tool. Non docker tools are fallen down except container orchestration tool, Kubernetes which usage increased by double.

- Enterprises and SMBs both sector are adopting Docker as their primary DevOps tools.

- AWS ECS is used by maximum number of organization as Container-as-a-Service(CaaS) as compare to other opponents.

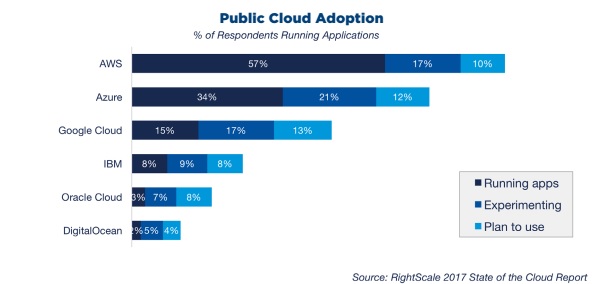

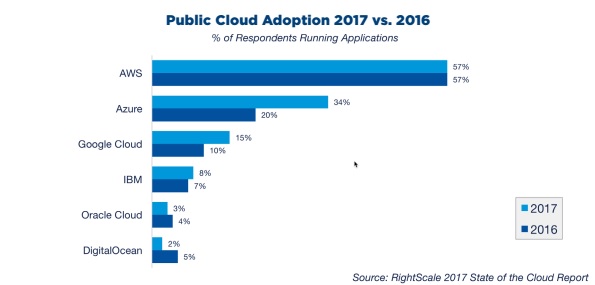

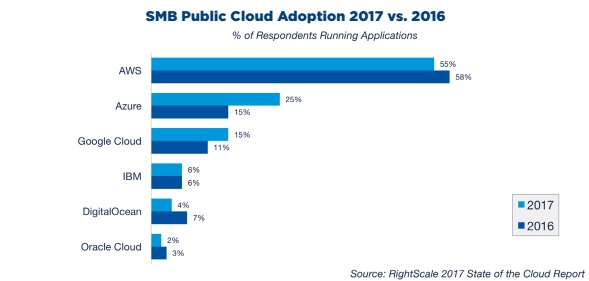

- AWS is leading public cloud services provider but the growth in customers remains flat as compare to 2015 & 2016. Growth of other counterparts of AWS has been increased which is alarming for AWS. Azure adoption raised from 20% to 34% and Google Cloud also reached to 15% from 10%. This is alarming for AWS that Azure is penetrating the leads and it seems to be reaching towards much bigger numbers in upcoming years.

- Growth of Azure is more significant for bigger enterprises as it was raised to 43% from 26%. Growth of AWS remains constant within enterprises. For SMBs, Azure adoption is grown from 15% to 25% and AWS remains flat.

- Top 4 public cloud used are AWS, Azure, Google Cloud & IBM

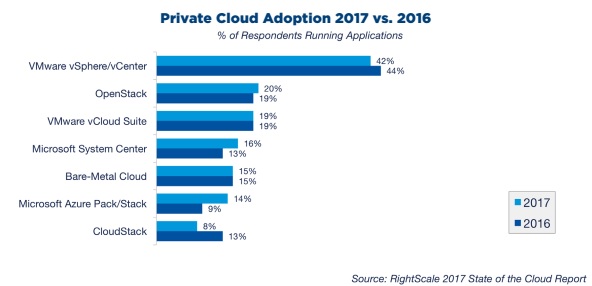

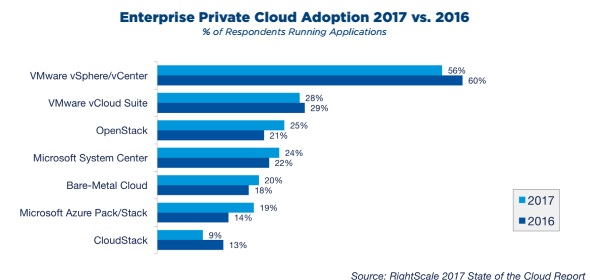

- Adoption of Private Cloud has decreased as compared to 2016. VMware vSphere is leading the chart with Openstack at number 2. Surprisingly, the number has grown for organizations who are experimenting or planning to use Microsoft Azure Pack/Stack with Openstack at 2nd position.

- For enterprises, VMware vSphere/vCenter and vCloud Suite are top 2 choices for deploying private cloud.

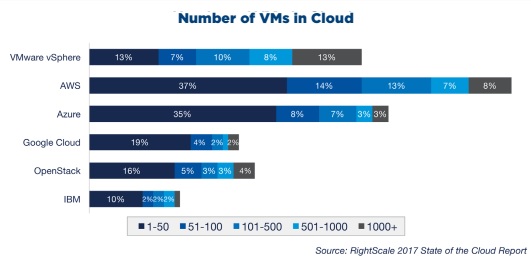

- AWS is hosting more number of VMs as compared to others.

Bessemer Venture Partners Report

- Cloud market was rocked at the start of the 2016. Drop was 35%. But after this, market gained the momentum and year end up with 15% increase.

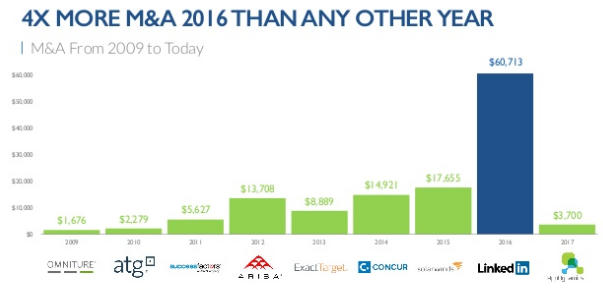

- Because the drop in market M & As increased, which is 4x more than any year with 40% of total market capital of $300 billion. As a result of all, number of cloud companies reduced.

- Public cloud companies hold market cap $300 billion. Salesforce(59,9) & LinkedIn(29.0) are 2 top companies in the list.

- There are more than 1000 cloud companies in cloud market. $400 billion market capital is made in top 200 companies and out of that top 100 companies holding $104 billion market capital.

- Key questions from top CEOs:

- How fast should I be growing?

- How much should I burn?

- How do I scale?

- How fast should I be growing?

- Study reveals that Dropbox is fastest company to hit $1 billion in 8 years

- Slack reached to $10 million landmark in just few months

- Cloud communication platform Twilio reached to $10 in 1 year.

- According to BVP, ideal growth benchmark for companies should as below

- Good: $1 to $10M in 5 years & $1 to $100M in 10 years

- Better: $1 to $10M in 3 years, $1 to $100M in 7 years

- Best: $1 to $10M in 2 years, $1 to $100M in 5 years

- How much should I burn?

- Rule of 40 = % Annual Revenue Growth + % Profit Margins

- Efficiency Score = % Annual CARR Growth + % Burn

- BVP Efficiency Rule (> $30M Average Rate of Return – ARR)

- Expansion ($30 to $60M ARR): 70% efficiency score

- IPO (~$100M ARR): 50% efficiency score

- Public (>$150M ARR): 30% efficiency score

- BVP Efficiency Rule (< $30M ARR)

- Net New ARR / Net Cash Burn > 1.

- How do I scale?

- Customer Acquisition Cost (CAC) Payback Period = Total Sales and Marketing Costs Last Quarter / New Committed Monthly Recurring Revenue(CMRR) Added Last Quarter * % Gross Margin

- CAC Cocktail Formula: Total Acquisition Costs = Sales productivity + Marketing spend + Sales Support.

- BVP Understanding Your Sales Model

CAC Payback AVG ACV Churn/Upsell SMB 3 to 6 months < $12k < 3% monthly Midmarket 12 months $12 to $50k 1% monthly Enterprise 18 to 24 months $50k+ < 1% monthly, upsell

- Predictions for 2017

- Year will be human assisted Artificial Intelligence (AI)

- APIs will become backbone for a majority of software infrastructure

- Architect for success in an infinite compute world. Cost optimize public cloud infrastructure as you grow;

- Mobile unlocks non desk worker productivity.

- NPS everything

- Companies with diverse teams will will gain growth

- The screenless software movement. We are in the era where 20% searches are voice. Devices will be more smarter in upcoming year

Be First to Comment