Current Landscape and Major Deployments

The telecom industry is witnessing a significant shift from vendor-centric radio access networks (RAN) towards a more open, multi-vendor ecosystem. This Open RAN transformation is being spearheaded by leading telecom companies such as Rakuten, Dish Networks, Optus, Telefonica, Vodafone, and Ooredo. Noteworthy deployments include Rakuten’s 23,000 sites in Japan and Dish’s 20,000 sites in the US.

Standardization and Community Efforts

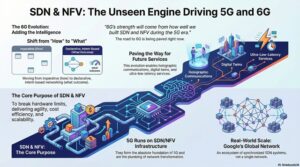

The Open RAN initiative is supported by collaborative efforts from organizations like the O-RAN Alliance, Telecom Infra Project (TIP), ETSI, and 3GPP. These entities are working together to standardize the technology, driving research and development (R&D) and conducting extensive trials. The contributions from a robust ecosystem of networking vendors further bolster these efforts. Additionally, the maturation of cloud infrastructure, optimized for distributed RAN deployments, plays a crucial role. Numerous pilot projects across Europe, North America, and Asia are currently underway, which are essential for broader deployment in existing (brownfield) environments. The Open RAN Alliance has made substantial progress in simplifying integration through comprehensive architectural designs, interface specifications, and test specifications to ensure compliance and interoperability.

Market Trends and Challenges

Despite these advancements, the market has faced setbacks. Stefan Pongratz from Dell’Oro Group recently reported a significant double-digit decline in the RAN technology market, expected to continue into 2024. However, there remains an optimistic forecast of 20 to 30% growth in the overall RAN market by 2023. This discrepancy raises questions among telecom leaders about the challenges hindering Open RAN and virtual RAN (vRAN) adoption over the past 12-18 months. Identifying and addressing these gaps is crucial for realizing the full benefits of Open RAN and supporting innovative services.

In this next part of this article, we will talk about what went wrong with OpenRAN adoption in India and at a global level.

Open RAN Adoption in India

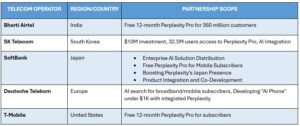

Let’s examine the adoption of Open RAN in India. The Indian telecom market features three major operators: Bharti Airtel, Vodafone-Idea, and Jio. Through my research, I identified several challenges these companies have encountered.

- Vodafone Idea Limited : The cost of deploying Open RAN technology often exceeds that of traditional RAN, making it less attractive. Challenges include a lack of chipset vendors, proven software developers, and limited interest from major companies like Nokia and Ericsson. Concerns about interoperability and network security further impede adoption. Despite these hurdles, Vodafone Idea has initiated a pilot deployment of commercial Open RAN technology in collaboration with Mavenir.

- Bharti Airtel Services emphasizes balancing cost and performance with Open RAN. Although the technology is rapidly evolving, it still lacks full feature parity with traditional systems. Concerns about accountability and the sustainability of the Open RAN ecosystem complicate adoption. Bharti Airtel is also conducting trials with Mavenir.

Global Challenges and Insights from the Open RAN Summit

Globally, telecom giants face similar challenges, as highlighted in a recent panel discussion at the Open RAN Summit organized by TelecomTV. The panel discussion included the following participants: Beth Cohen (Verizon), Ian A. Hood, P. Eng. (Red Hat), Matteo Fiorani (Ericsson), Patrick Lopez ({Core Analysis}), Petr Lédl (Deutsche Telekom), and Rick Mostaert (Mavenir). Key insights include:

Expectations vs. Reality: Telecom operators initially focused on Total Cost of Ownership (TCO) but are now considering enterprise revenue opportunities and improved customer experience. However, they underestimated the importance of automation and lifecycle management for operational efficiency.

Complexity and Integration: Deploying and managing Open RAN is more complex compared to traditional single-vendor systems. This complexity presents significant operational challenges.

Market Adoption: Adoption has been slower than anticipated, with many operators waiting for successful integrations and deployments by others before committing.

Performance and KPIs: Ensuring that Open RAN systems meet the performance and key performance indicators (KPIs) of traditional networks, especially in large-scale deployments, remains a critical challenge.

In summary, while the Open RAN movement holds promise for transforming the telecom industry, significant hurdles remain. Addressing these challenges through continued standardization, pilot projects, and collaboration among ecosystem players is essential for achieving broader adoption and realizing the full potential of Open RAN.

Be First to Comment