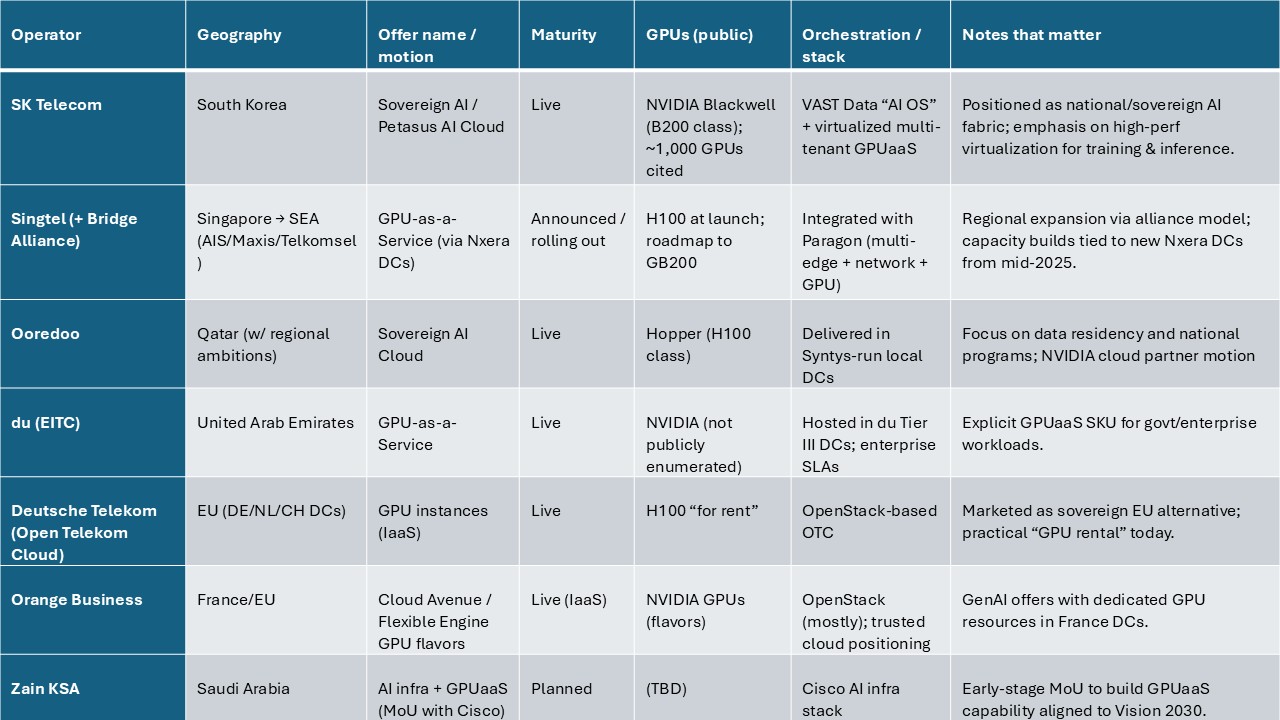

GPU-as-a-Service (GPUaaS) is quickly becoming a hot topic for telcos. I’ve shared a bit about it in my earlier posts, and this time I’m taking a closer look at the latest announcements and launches from operators who are bringing GPUaaS (and related services) to their enterprise and B2B customers.

The buzz around GPU-as-a-Service (GPUaaS) in telecom is growing rapidly. Headlines often highlight billion-dollar AI ambitions, but when you zoom in, the ground reality is far more nuanced. Delivery models, adoption patterns, and execution timelines are shaping up in complex—and sometimes surprising—ways.

- Sovereignty as the Differentiator

While hyperscalers dominate the global GPU market, telecom operators are carving out their own lane: digital sovereignty.

For enterprises and governments in highly regulated sectors—finance, defense, healthcare, energy—keeping data and compute within national borders isn’t optional; it’s mandatory.

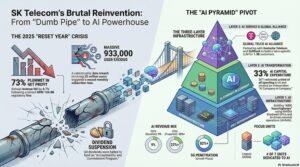

That’s why operators like SK Telecom (Korea), Ooredoo (Qatar), Deutsche Telekom (EU), and Orange Business (France) are positioning GPUaaS explicitly as sovereign AI clouds. This narrative aligns neatly with national AI strategies focused on data residency and homegrown innovation.

👉 Sovereignty is emerging as the single biggest wedge telcos can drive into the GPUaaS market.

- NVIDIA at the Core—But Ecosystem Is the Real Game

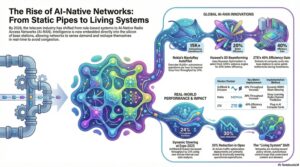

Every telco GPUaaS deployment today runs on NVIDIA GPUs—from H100/Hopper to the coming Blackwell/GB200. But the silicon is only the starting point.

The real battleground? The ecosystem around GPUs—software, storage, networking, and orchestration.

- SK Telecom leans on VAST Data’s AI OS for near bare-metal performance in multi-tenant environments.

- Singtel integrates GPUaaS with its Paragon platform, blending GPU resources with edge compute and 5G network slicing.

- Ooredoo and du pitch enterprise-grade SLAs and sovereign data centers.

- Open Telekom Cloud emphasizes its EU-trusted OpenStack platform.

👉 For enterprises, the question isn’t “Who has GPUs?” but “Who can deliver a usable, secure, and scalable AI platform?”

- Scaling Through Alliances

Telcos know they can’t compete with hyperscalers chip-for-chip. Their counter-strategy: alliances.

Singtel’s Bridge Alliance extends GPUaaS access across Southeast Asia—from AIS (Thailand) to Maxis (Malaysia) and Telkomsel (Indonesia). Similar collaborations are being explored in the Middle East, pooling scarce GPU resources while maintaining sovereign controls.

👉 Expect alliances to become the default growth model, giving enterprises a regional alternative to hyperscaler clouds.

- Early Market, Constrained Reality

Forecasts suggest telco GPUaaS could top $20B in revenues by 2030. But today, reality looks constrained:

- GPU shortages (thanks to NVIDIA’s supply bottlenecks).

- Energy & cooling challenges in telco-run data centers.

- Talent gaps in managing GPU clusters at scale.

That’s why many telco announcements arrive before services are truly available. In practice, enterprises should expect: GPU queues, premium pricing, and staggered rollouts for at least the next 2–3 years.

- Not Every Operator Wants In

It’s worth noting: not every telco is diving headfirst into GPUaaS.

Bharti Airtel (India), for example, has said it won’t build GPUaaS for now, preferring to double down on data center services and hyperscaler partnerships.

This signals an emerging divide:

- Some telcos will become GPUaaS providers,

- Others will play orchestrator, wrapping managed services around hyperscaler AI platforms.

Bottom Line

Telecom operators have a unique opportunity to stake a claim in AI infrastructure by offering sovereign, regulated, and network-integrated GPUaaS. But execution challenges—GPU supply, ecosystem maturity, and viable pricing models—mean the category is still very young.

For enterprises, telco GPUaaS makes sense when:

- Data residency and sovereignty are critical.

- Local regulatory compliance is non-negotiable.

- Proximity to 5G/edge networks unlocks latency-sensitive AI use cases.

The next 24–36 months will determine whether GPUaaS becomes a mainstream telco revenue stream—or remains a niche sovereign alternative to hyperscaler AI clouds.

Be First to Comment