Telecom networks are on the brink of their most profound shift since the dawn of mobile broadband. The next leap won’t come from more spectrum or faster radios — it will come from bringing cloud-like compute power to the very edge of the network.

Edge computing has emerged as one of the most critical innovations shaping the digital infrastructure landscape. For telecom operators, it’s more than just an IT upgrade — it represents a foundational capability to evolve from being traditional connectivity providers (Telcos) to becoming full-fledged technology companies (Techcos).

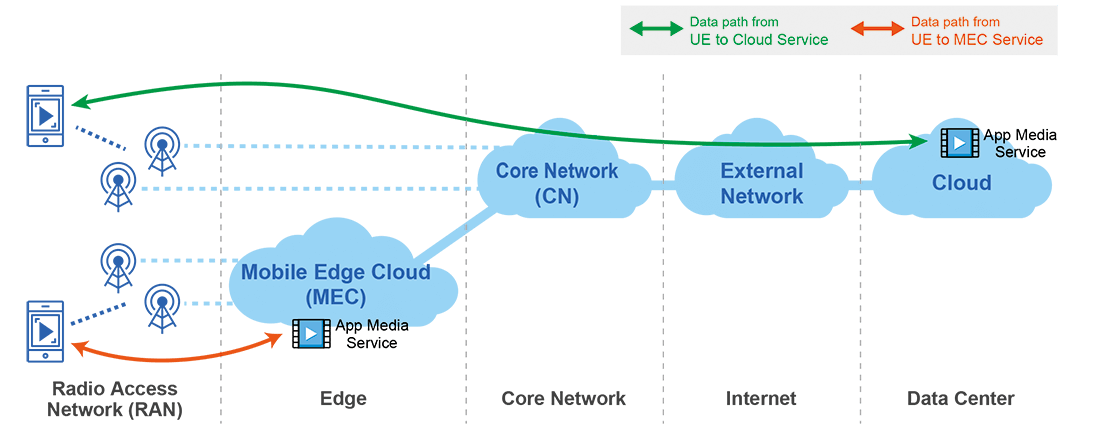

While edge computing has been a buzzword for years, many myths still surround how telecom operators are approaching it. Contrary to popular belief, MEC (Multi-access Edge Computing) is not part of the RAN hardware, but rather a parallel compute layer deployed close to the RAN to reduce latency and network stress while enabling real-time digital services.

Understanding Edge Computing in a Telecom Context

- Definition: MEC is a distributed compute infrastructure placed close to end users — at cell sites, central offices, or metro data centers — instead of far-away cloud data centers.

- Purpose: It processes data locally, enabling low-latency use cases like AR/VR, autonomous vehicles, real-time gaming, video analytics, and industrial automation.

- Separation from RAN: MEC works with the RAN but is not part of it. MEC servers are dedicated compute units deployed alongside or near RAN infrastructure, often co-located at the same physical site as radios and baseband units but operating independently.

- Ideal locations: Centralized RAN (C-RAN) hubs, where processing power is aggregated, are prime sites to host MEC servers. MEC interfaces with 5G’s split architecture (Central Units and Distributed Units) as an additional compute layer.

- APIs and Intelligence: MEC servers can consume radio data (like user location or signal conditions) via RAN APIs to optimize performance-sensitive workloads.

Global Telecom MEC Deployments

- Verizon (USA) — Verizon 5G Edge (AWS Wavelength) bringing AWS services into Verizon’s 5G edge for ultra-low latency apps and developer tooling. Source

- AT&T (USA) — AT&T Multi-Access Edge Compute (edge zones / 5G Edge zones) and industry-focused edge zones for low-latency services. Source

- Vodafone (Europe / Global) — Vodafone Business MEC / Distributed Edge (operator + hyperscaler integrations) for enterprise/near-real-time use cases. Source

- Telefónica / O2 (Spain, Germany, Latin America) — Telefónica MEC and 5G + edge initiatives for industrial use cases and hyperscaler partnerships (Lenovo, AWS). Source

- Orange (France / Africa) — Orange 5G Lab + Google Cloud / Anthos edge projects and localized Edge Labs for industry pilots and regional deployments. Source

- Deutsche Telekom (Germany / Europe) — “Telekom Edge Cloud” and site-level edge data centers (examples: VW port pilot), plus recent AI/edge cloud initiatives (NVIDIA collaboration). Source

- SK Telecom (South Korea) — SKT 5GX Edge / 5G Edge Cloud (including AWS Wavelength collaboration) and GPU-accelerated edge services for enterprise/AI workloads. Source

- NTT DOCOMO (Japan) — docomo MEC (nationwide MEC design, GPU-accelerated enterprise MEC and cloud-rendering/AR/VR tests). Source

- Telstra (Australia) — Telstra Edge (part of Adaptive Cloud) with Microsoft/Ericsson collaborations — 5G-enabled edge compute for enterprises. Source

- China Mobile / China Telecom / China Unicom (China) — major domestic MEC programs (China Mobile technical white papers and China Telecom MEC data-center rollouts / pilots supporting gaming, industrial use cases). Source

- Reliance Jio (India) — Jio Platforms’ MEC/edge offerings and rollout across many facilities (5G SA + MEC expansion; private 5G / enterprise edge focus). Source

Why MEC Can Be a Game-Changer for Telecom Operators

- New revenue streams: Offers platform-based services to enterprises — enabling real-time analytics, AI/ML workloads, industrial automation, and immersive consumer experiences.

- Performance differentiation: Reduces latency drastically, improving QoE for advanced 5G use cases like AR/VR, autonomous mobility, and smart manufacturing.

- Efficient network utilization: Processes heavy data workloads locally, reducing backhaul strain and optimizing network resource usage.

- Telco-to-Techco evolution: Provides a clear path for operators to move beyond connectivity and become edge cloud providers — unlocking new digital service opportunities.

- Strategic position in the value chain: Places telcos at the center of next-generation application ecosystems, rather than just being transport providers.

As Satya Nadella aptly said, the future of computing is about “processing data closer to its source to unlock speed and efficiency.” This perfectly encapsulates the opportunity that MEC offers to telecom operators — to reshape their role in the digital economy and become the backbone of next-gen innovation.

I’d love to hear how you see this shift playing out across our industry. Do you see MEC as the inflection point where telecom operators finally transition from bandwidth providers to full-fledged tech platforms? What’s the biggest blocker you see for large-scale MEC adoption — technology maturity, monetization models, or mindset shift within telcos?

Be First to Comment